Click here to see how I answered my Summons for less than $20

Win Your Lawsuit

Did you know that every single collection agency that sues a consumer is looking for a default judgment?

When I was sued, I looked up the collection agency and saw literally hundreds of cases filed and about 98% of them ended up in a default judgment. People who have old credit card debt need to really consider fighting back.

Why would you let someone sue you if you don’t owe them anything? It was the original creditor you defaulted on, not these agencies. So, make them prove it.

Just by you answering their complaint makes more than 50% of these companies back off and voluntarily dismiss the case. I learned that as long as I denied every single count on their claim, they couldn’t file a summary judgment against me, and I fought back and won every single time.

Where is the contract you are suing me for? What is this affidavit that is signed by your company and not the original creditor? That is considered hearsay so that won’t work. Where is the assignment of debt? Show me that my bank assigned all their rights over to you to collect this debt. Show me that I owe you money and not the original creditor.

Don’t just sit there and think that you’re doomed because you are not, not if you fight back. Look around this website and see what I did to get these idiots off my back. So many consumers have no clue about their rights.

Just because you are being sued doesn’t mean you’re doomed it means this:

- They sue you and hope you don’t answer the complaint so that they can get a default judgment against you and go after your bank account and garnish your wages.

- If you answered the lawsuit and denied everything, they cannot go for a summary judgment against you yet. And that is the second thing they are looking for. To sue you, you admit some part of the debt and they nail you by admission.

- Seeing that you answered the complaint, the next thing they want to do is hurry up and send you discovery hoping that they will get you to mess that up by admitting the debt, or they will try to trap you with trick questions. They’ll ask you something in the interrogatories and then ask you it again, in different words, in the admissions. Be careful

- If you irritate them and have answered the complaint on time, and have answered their discovery on time, the chances are they are going to file a motion to dismiss or not show up in court and then you win by default.

How do you stop that? You need to answer the lawsuit or check your local court rules and see if they failed to comply with those rules and if you can file a motion to dismiss in lieu of an answer.

If you feel you don’t owe this company anything then you know what to do.

They also hope you don’t realize that you only have 20-30 days depending on your local court rules to answer your discovery (especially admissions). If you do not answer their request for admissions on time, these agencies can file what is called a motion to deem admissions. This means that you didn’t answer their admissions on time and so, by law, they are deemed admitted. Once they get that motion they can hurry up and file a summary judgment against you. So watch the time limit here and answer this promptly or face the consequences.

These companies are well known for dragging this out for as long as possible hoping you make a mistake one way or another. Hang in there, read your local court rules and fight them every step of the way.

Old credit card debt is especially hard to prove in a court of law. They have to have the contract that was signed by you and if they cannot provide that, they’ll need an affidavit that is signed by the original creditor and not the collection agency. It must be signed by the original creditor only.

Any affidavit coming from the collection agency is hearsay which means they were not present when the debt incurred and therefore cannot testify to the truth of the debt.

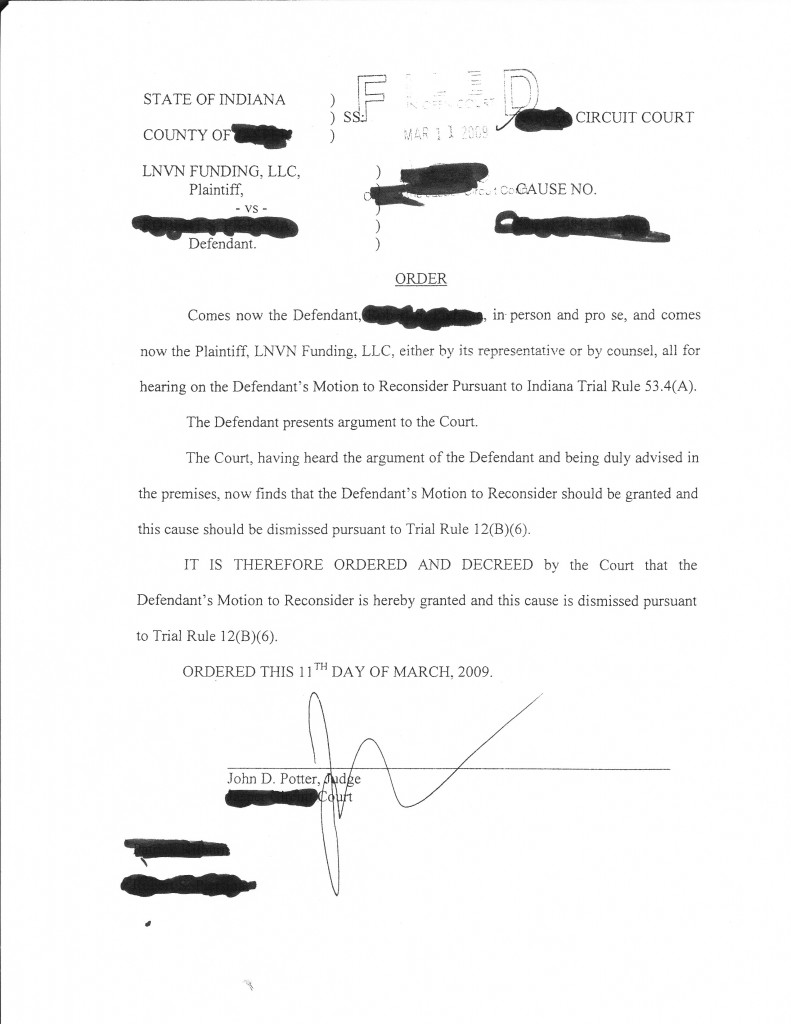

I got my case dismissed and so can you. Click here to learn how

I won my lawsuit!

Related Posts